찾고, 배우고, 성공하세요.

이민자 커뮤니티에게 매우 유용한 정보

무료 온라인 수업을 수강하세요

어디서나 학습

휴대폰과 컴퓨터로 학습할 수 있습니다. 언제 어디서나 공부해 보세요.

간편하게 이용

나만의 속도로 공부하세요. 원하는 만큼 수업을 받고 퀴즈를 풀 수 있습니다.

나만을 위한 수업

영어 학습자를 위한 수업을 만나보세요.

GED® 수업

GED® 학위를 온라인으로 공부하세요. 고등학교 졸업장이 있으면, 대학에 진학하거나 더 좋은 직장에 취업하실 수 있습니다.

수업 듣기

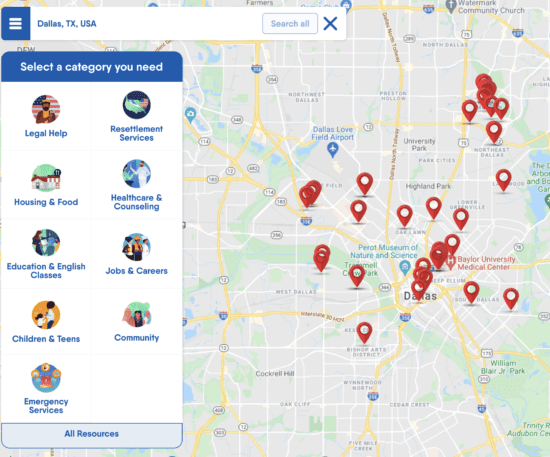

근처에서 도움받기

법률 지원, 영어 수업, 진료소, 주택 지원 등에 대해 알아보세요. FindHello 앱으로 미국 내 이민자를 위한 지역 지도와 서비스 목록을 검색하실 수 있습니다.