ፈልጉ። ይማሩ። ይደጉ።

የስደተኞች ማህበረሰቦች የሚተማመኑበት መረጃ

ነጻ የሆነ የመስመር ላይ(ኦንላይን) ትምህርት ይማሩ

የትም ይማሩ

በስልክዎ ወይም በኮምፒውተርዎ ያጥኑ። የትም ብትሆኑ በማንኛውም ጊዜ መማር ትችላላችሁ።

ለመጠቀም ቀላል

በራስዎ ፍጥነት ይሂዱ። ትምህርቶችን ያንብቡ እና የፈለጉትን ያህል ጊዜ ጥያቄዎችን ይውሰዱ።

ለእርስዎ የተሰራ

ትምህርቶቻችን የተዘጋጁት ለእንግሊዝኛ ቋንቋ ተማሪዎች ነው።

GED® ክፍል

ለGED® ዲፕሎማዎ በመስመር ላይ ይማሩ። በሁለተኛ ደረጃ ዲፕሎማ፣ ኮሌጅ መግባት ወይም የተሻለ ስራ ማግኘት ትችላለህ።

ክፍሉን ይውሰዱ

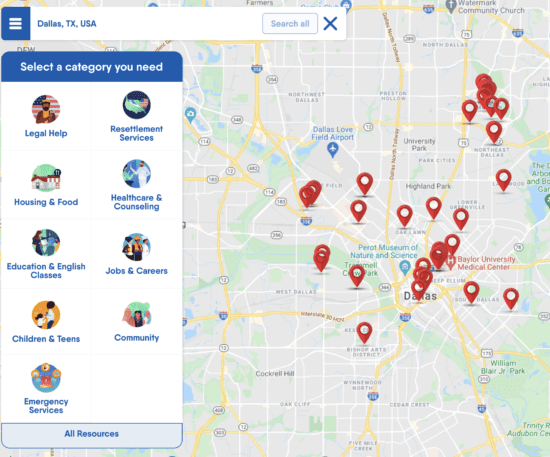

በአቅራቢያዎ እርዳታ ያግኙ

የሕግ እርዳታ፣ የእንግሊዝኛ ትምህርቶችን፣ የጤና ክሊኒኮች፣ የመኖሪያ ቤት ድጋፍ እና ሌሎችንም ያግኙ። FindHello በተባለው መተግበሪያ አማካኝነት በአሜሪካ ለሚገኙ ስደተኞች የአካባቢ ካርታ እና የአገልግሎት ዝርዝርን ይፈልጉ።