Raadi. Baro. Barwaaqow.

Macluumaadka ay bulshooyinka soo galootiga ah ku tiirsan yihiin

Ku qaado fasal bilaash ah onleen

Wax ku baro meel kasta

Wax ku baro taleefankaaga ama kombayutarka. Baro wakhti kasta, meel kasta oo aad joogto.

Fudud in la isticmaalo

Ku soco xawaarahaaga. Akhri casharrada oo qaado su'aalo inta jeer ee aad rabto.

Laguu sameeyey adiga

Fasalladeena waxaa loo sameeyay bartayaasha luuqadda Ingiriisiga.

Ku baro GED ®® dibloomadaada onleen. Diploma dugsiga sare ah, waxaad ku tagaan kartaa kulleyga ama shaqo wanaagsan hesho.

Ku biir fasalka

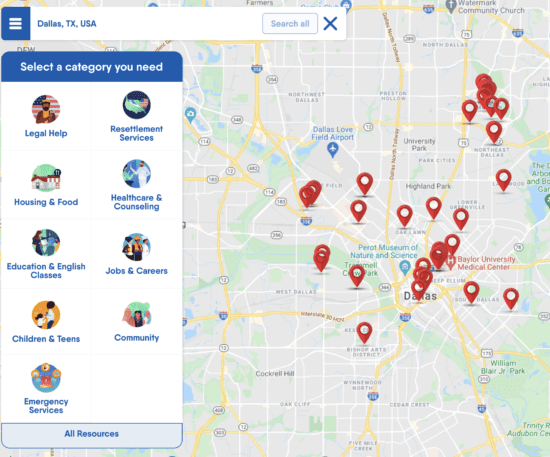

Hel caawimo xagga sharciga ah, fasallo Ingiriisi ah, rugo caafimaad, taageerada hoyga, iyo qaar kaloo badan. Ka raadi khariidadda maxaliga ah iyo liiska adeegyada loogu talagalay soo galootiga dalka Maraykanka oo wata app FindHello.