Hanapin. Matuto. Magsikap.

Impormasyon na inaasahan ng mga immigrant community

Kumuha ng isang libreng klase online

Matuto kahit saan

Mag-aral gamit ang iyong telepono o isang computer. Matuto anumang oras, nasaan ka man.

Madaling gamitin

Gamitin sa sarili mong panahon Magbasa ng mga aralin at kumuha ng mga pagsusulit nang maraming beses hangga't gusto mo.

Ginawa para sa iyo

Ang aming mga klase ay ginawa para sa mga nag-aaral ng wikang Ingles.

GED® na klase

Mag-aral para sa iyong GED® diploma online. Sa isang diploma sa high school, maaari kang pumunta sa kolehiyo o makakuha ng mas mahusay na trabaho.

Sumali sa klase

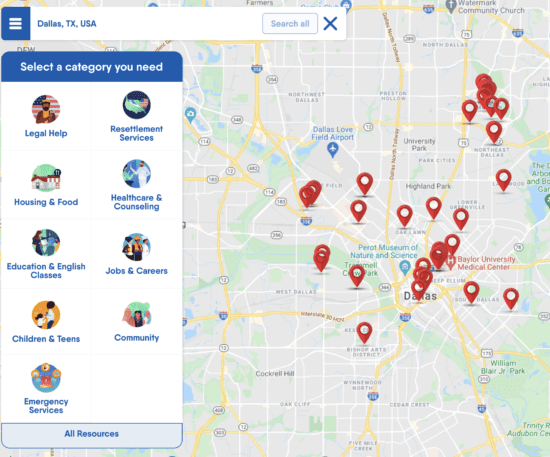

Maghanap ng tulong na malapit sa iyo

Maghanap ng legal na tulong, mga klase sa Ingles, mga klinika sa kalusugan, suporta sa pabahay, at marami pa. Maghanap ng isang lokal na mapa at listahan ng mga serbisyo para sa mga imigrante sa USA gamit ang app FindHello.