Знайти. Навчатися. Процвітати.

Інформація, на яку покладаються іммігрантські спільноти

Відвідайте безкоштовне онлайн заняття

Навчайтесь будь-де

Навчайтесь з вашого телефону або комп'ютеру в будь-який час, у будь-якому місці.

Легко використовувати

Обирайте власну швидкість. Читайте теорію і відповідайте на запитання скільки завгодно разів.

Зроблено для вас

Наші заняття були розроблені для людей які вивчають англійську мову.

Курс для іспиту GED®

Підготуйтеся до отримання атестату GED® онлайн. З атестатом про повну загальну середню освіту ви зможете вступити до коледжу та отримати кращу роботу.

Розпочніть заняття

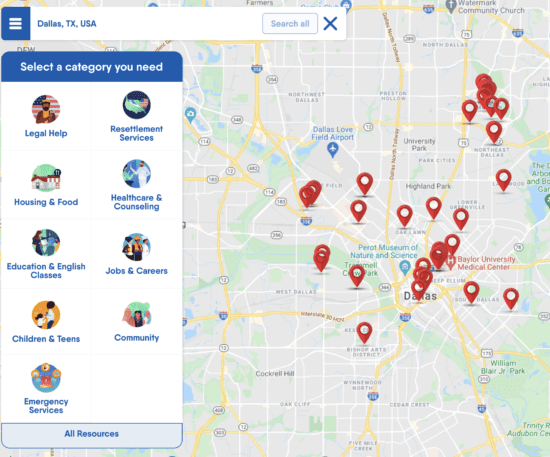

Знайдіть допомогу поруч

Знайдіть юридичну допомогу, курси англійської мови, медичні клініки, житлову допомогу та багато іншого. Шукайте місцеву карту та перелік послуг для іммігрантів у США за допомогою застосунку FindHello.