Tafuta. Jifunze. Stawi.

Taarifa ambazo jamii za wahamiaji wanazitegemea

Hudhuria katika darasa la mtandaoni bila malipo

Jifunze popote

Jifunze kwenye simu yako au kwenye kompyuta. Jifunze wakati wowote, popote ulipo.

Rahisi kutumia

Nenda kwa kasi yako mwenyewe. Soma masomo na fanya maswali mara nyingi kadri upendavyo.

Imetengenezwa kwa ajili yako

Madarasa yetu yaliandaliwa kwa ajili ya wanafunzi wa lugha ya Kiingereza.

Darasa la GED®

Jifunze diploma yako ya GED® mtandaoni. Ukiwa na cheti cha sekondari, unaweza kwenda chuo kikuu au kupata kazi bora.

Hudhuria darasani

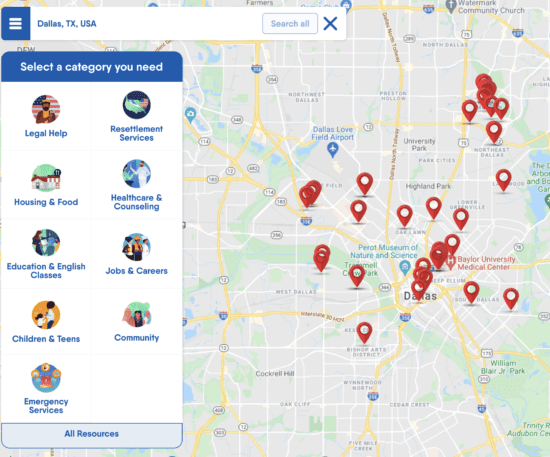

Kupata msaada ulio karibu na wewe

Pata msaada wa kisheria, madarasa ya Kiingereza, kliniki za afya, msaada wa nyumba, na zaidi. Tafuta ramani ya eneo lako na orodha ya huduma kwa wahamiaji nchini Marekani na programu ya FindHello.