Ki jan fè yon bidjè pou ekonomize lajan

Kreye bidjè ou alantou chèk ou. Èske w peye chak semèn, chak de semèn oswa chak mwa? Fè bidjè ou alantou peryòd peman ou.

- Ekri revni ou chak mwa oswa chak semèn

- Fè yon lis depans chak mwa oswa chak semèn: manje, sèvis piblik, lwaye, pri otobis, oswa prè machin pou egzanp.

- Fè yon lis lòt depans ou dwe peye: asirans, bòdwo reparasyon, depans lekòl

- Lis konbyen lajan ou bezwen mete sou kote: pou egzanp, ou pral vle ekonomize lajan pou ijans epi ekonomize pou acha oswa pou vwayaj.

- Ajoute yon kantite lajan pou amizman oswa lòt bagay ou vle depanse sou. Jis sonje li bon pou achte bagay ou bezwen yo anvan bagay ou vle yo!

Si revni ou pa kouvri tout depans ou, bidjè ou pa ekilibre. Si w pa ka ogmante revni w, w ap bezwen diminye depans kote w kapab.

Ekonomize lajan epi kenbe dosye yo

Si w gen kèk lajan ki rete apre depans ou yo fin kouvri, kòmanse ekonomize! Pi bon fason pou ekonomize lajan se lè w mete l nan kont epay ou. Ou ka itilize ekonomi w yo si w gen yon ijans. Ekspè yo rekòmande ou kreye yon fon ijans ki egal a sis mwa depans si ou pèdi travay ou oswa si ou blese. Apre ou fin konstwi yon fon ijans, Lè sa a, ou ka ekonomize lajan pou fè yon bagay ki amizan, tankou ale nan yon vakans ak fanmi ou oswa achte yon bagay espesyal.

Asire w ke w peye tout bòdwo w yo alè pou w pa oblije peye okenn frè anreta. Kenbe tout resi enpòtan ou yo ak dosye sou fason ou depanse lajan ou nan yon bwat, tiwa oswa dosye.

Tcheke deklarasyon kont labank ou. Li ba ou dosye detaye sou depans ou yo. Li gid nou pou bankè nan Etazini.

Kredi

Kredi vle di prete lajan nan bank oswa inyon kredi epi ranbouse l pita. Lè ou prete lajan lè l sèvi avèk kredi, w ap oblije peye enterè oswa yon frè pou prete lajan an.

Li enpòtan pou peye tout bòdwo w yo alè pou w pwoteje kredi w. Si ou vle achte yon kay yon jou, ou ka bezwen sèvi ak kredi. Ou ka aprann plis sou kat kredi ak prè.

Si w deside jwenn yon kat kredi, ou bezwen pran anpil prekosyon pou w peye bòdwo w yo nèt chak mwa. Kat kredi ka itil men souvan fè w peye yon enterè trè wo si ou pa peye yo chak mwa. Pa depanse plis lajan ke ou genyen!

Fwòd

Fè atansyon lè w ap bay moun ou pa konnen lajan, sitou si w ap peye ak lajan. Li pi bon pou w jwenn yon kont kouran nan yon bank oswa yon inyon kredi pou w ka peye pa chèk epi answit ou gen prèv w peye bòdwo w yo. Si ou oblije peye lajan kach, toujou mande yon resi pou w gen prèv peman.

Gen kèk magouy (trik pou twonpe moun) ki vize moun ki nouvo nan peyi sa a epi ki poko pale Anglè byen. Si ou resevwa lapòs oswa imèl ki di ou bezwen peye anpil lajan oswa ke ou te genyen anpil lajan, li se pwobableman yon tronpe oswa fo. Tcheke ak biwo lapòs la, volontè/konsè w la, oswa yon zanmi oswa yon vwazen ou fè konfyans si w pa sèten.

Si w ap konsidere achte, envesti oswa peye pou yon bagay, li akseptab pou mande yon akò alekri oswa di ou bezwen pale ak mari oswa madanm ou oswa reflechi sou òf la. Pa santi w presyon pou w peye yon gwo kantite lajan san dokiman oswa tan pou w mande konsèy.

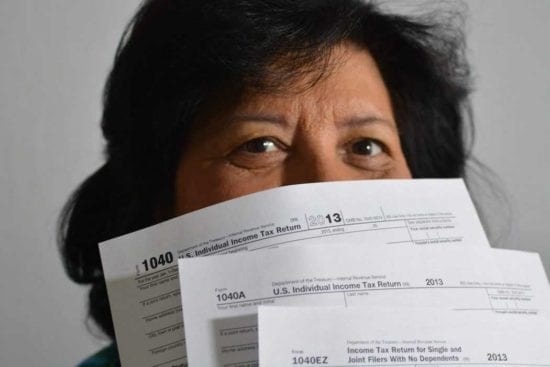

Taks

Nan Etazini, tout moun oblije rapòte anvan 15 avril chak ane konbyen revni yo te resevwa nan ane anvan an. Yo rele rapò sa a yon deklarasyon taks. Ou ka dwe taks sou revni sa a. Taks yo se lajan ou peye gouvènman an pou sèvis piblik ou resevwa yo, tankou lekòl pou pitit ou yo ak wout pou w kondui. Ou ka aprann plis sou taks ak kijan pou peye taks. Tou depan de kantite lajan ou fè, sepandan, ou ka resevwa yon ranbousman (lajan tounen nan men gouvènman an) sou taks ou te deja peye pandan ane a.

Lè w resevwa yon chèk, y ap retire kèk kòb ladan l pou kouvri sèten taks. Anplwayè w ap kenbe kèk kòb nan chèk ou pou bay gouvènman an pou ou. Sa yo rele taks retenu. Sa gen ladann taks leta ak federal, asirans chomaj, ak sekirite sosyal, ki se ekonomi pou retrèt oswa andikap.

Objektif nou se pou ofri enfòmasyon ki fasil pou konprann e ki ajou regilyèman. Enfòmasyon sa a se pa konsèy legal.