Kat kredi

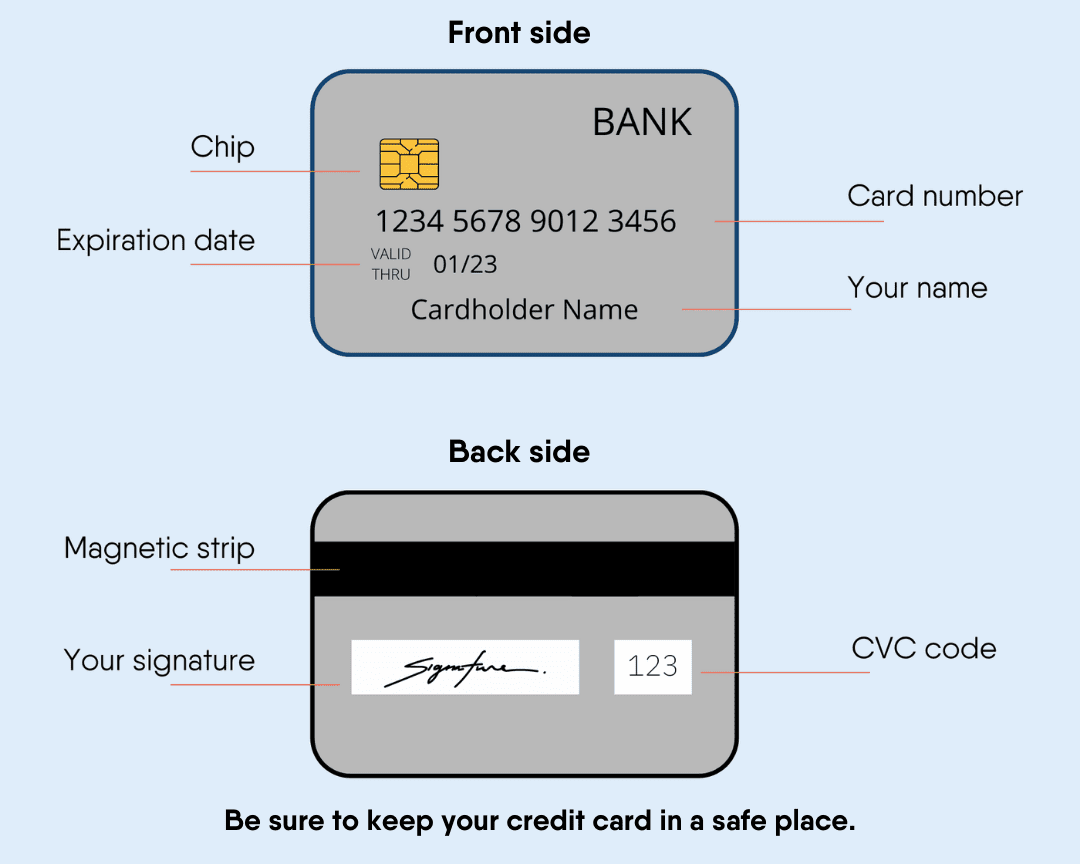

Gen plizyè milyon moun ki gen kat kredi Ozetazini. Moun itilize kat kredi lè yo ap achte an liy, peye pou yon bagay chè, oswa lè yo pa vle itilize lajan kach.

Kat kredi yo fasil epi san danje pou itilize. Anjeneral, yo gen yon limit sou konbyen lajan ou ka depanse epi yo egzije pou w fè yon peman minimòm nan konpayi kat kredi a chak mwa. Li enpòtan pou toujou peye peman minimòm yo mande a oswa ou pral gen pou w peye yon frè reta.

Si ou pa peye konpayi kat kredi a tout kantite lajan pou tout acha ou fè yo, ou pral gen yon balans ki rete pou w peye. Balans lan ki sou kat kredi ou a pral ogmante poutèt enterè anjeneral. Enterè se yon frè adisyonèl konpayi kat kredi an pran sou ou paske l kite ou prete lajan. Balans la se yon montan yo konsidere kòm yon dèt.

Anpil moun gen yon balans sou kat kredi yo. Dèt kapab bay estrès. Li enpòtan pou fè acha sou yon kat kredi ou konnen ou ka peye nan yon kantite tan rezonab.

Jwenn kat kredi k ap pi bon pou ou.

Lòt kalite kat

Gen lòt kalite kat ou ka itilize olye yon kat kredi estanda.

Pou louvri yon kat kredi sekirize, ou pral bezwen depoze lajan. Depo minimòm lan nòmalman plis pase $40, epi nan kèk ka, sa ka ba ou yon kredi $200. Moun ki louvri kat kredi a kenbe lajan sa a pandan kont lan ap louvri a. Si ou fè peman ou a tan, ou kapab benefisye ranbousman depo w te fè a epi w ka pran yon kat kredi regilye.

Kalite kat sa ap ede ou konstwi istorik kredi ou.

Kat prepeye se yon lòt opsyon si ou pa ka jwenn yon kat kredi.

Li gen yon kantite maksimòm lajan ki ajoute sou li, epi gen kèk ki gen opsyon pou ajoute plis lajan. Nenpòt moun ka achte kat sa yo. Ou ka jwenn kat sa yo nan makèt, magazen, ak estasyon gaz.

Ou ka fè acha ak yon kat prépayé menm jan ou fè ak yon kat kredi regilye. Yo ka itil pou peman USCIS ak lòt peman an liy.

Genyen yon kat prepaye pa pral ede ou bati kredi ou.

Gade videyo sa a pou w konn sa k ap pase lè ou pa tcheke frè ki gen nan kat prepeye yo.

Kredi videyo: Federal Trade Commission

Ou ka itilize kat debi yo menm jan ak yon kat kredi. Ou ka jwenn yon kat debi apre ou fin louvri yon kont labank oswa kont kredi sendika. Li pa pèmèt ou prete lajan. Li ka sèlman itilize lajan ki sou kont ou a. Pafwa gen frè.

Yon kat debi pa ede ou bati kredi ou. Aprann plis.

Si ou pa gen yon nimewo sekirite sosyal pou aplike pou yon kat kredi, kèk konpayi ka aksepte Nimewo Idantifikasyon Kontribyab Endividyèl ou (Individual Taxpayer Identification Number, ITIN).

Yon lòt opsyon pou moun ki pa gen nimewo sekirite sosyal yo genyen se sèvi ak yon kat kredi sekirize.

Prè

Yon prè se lajan ou prete epi w dwe ranbouse ak enterè. Genyen anpil diferan kalite prè: pèsonèl, paye, biznis, ak lòt moun.

Yon prè se lajan ki soti nan yon bank oswa yon enstitisyon finansye an jeneral. Yo pral tcheke konbyen lajan ou touche soti nan travay epi si ou posede bagay sa yo ki gen valè. Sa a ede yo deside si yo ka fè konfyans ou pou peye tounen prè a.

Fè peman ou alè ap pèmèt ou soti nan dèt epi sa ap ede ou bati kredi ou.

Prè sou salè yo se pou moun ki bezwen lajan kach byen vit. Moun prete lajan nan men yon kreditè pou peye tounen nan jou a yo jwenn peye.

Prè sa yo pote non prè lajan kach annavans epi yo souvan pran gwo enterè sou yo.

Gen kèk kreditè prè sou salè k ap itilize pratik ilegal tankou enterè ki twò wo ak kondisyon prè ki enjis. Tanpri asire w ke ou konnen tout detay ki genyen nan prè a anvan ou siyen.

Kowoperativ kredi yo konn ofri opsyon prè altènatif sou salè (PAL). Yon PAL se yon prè a kout tèm, kidonk ou pa bezwen jwenn yon prè paie.

Ou ka prete jiska $1,000, epi yo pa pral fè w peye enterè ki twòp. Ou gen yo dwe yon manm kredi sendika pou yon mwa anvan ou pran soti yon PAL.

Ipotèk yo se prè moun jwenn pou achte yon kay. Yon kreditè tcheke istwa travay ou, nòt kredi, revni, ak lòt faktè yo wè si ou ka jwenn yon ipotèk. Chak kreditè gen diferan pousantaj enterè ak opsyon.

Jwenn yon ipotèk ka konplike. Li bon pou mande realtor ou oswa zanmi pou sijesyon sou ki kote yo ka resevwa yon ipotèk. Ou pral bezwen anpil dokiman tankou fòm taks federal, peye stubs, deklarasyon labank, ak plis ankò.

Administrasyon Federal Lojman an (Federal Housing Administration, FHA) gen resous sou ipotèk ak fason pou achte yon kay.

Yon rezidan pèmanan (yon moun ki gen yon Green Card) ka jwenn yon ipotèk. Ou pral bezwen dokiman ki montre ou ap viv legalman nan peyi Etazini pou aplike. Apre sa, ou pral bezwen respekte kondisyon bank la oswa kreditè a. Gen kèk dokiman obligatwa yo se:

- Kat Vèt

- Paspò

- Nimewo Sekirite Sosyal

- Dènye souch peman

- Fòm W-2

- Deklarasyon taks

- Relve bank yo

- Nòt kredi

Yon rezidan pèmanan kapab kalifye pou prè FHA tou. Tèm ak kondisyon yo se menm ak sa sitwayen ameriken yo.

Rezidan ki pa pèmanan yo ka aplike pou yon ipotèk tou. Pwosesis sa a pi konplike. Aplikan yo dwe montre yo ap viv legalman Ozetazini. Nan pifò ka yo, yon moun ki pa yon rezidan pèmanan ap gen pou l montre revni l genyen aletranje yo.

Prè etid yo se pou moun kap chèche èd pou peye pou lekòl. Ou pral oblije ranbouse l apre epi ak enterè. Lajan prè yo soti nan yon bank, yon enstitisyon finansye, oswa nan fon gouvènman an. Li plis konsènan prè pou etid yo epi jwenn opsyon.

Gen bousdetid pou imigran ak refijye pou ede w peye pou edikasyon ou.

Sa yo se prè pou amelyore oswa lanse pwòp biznis ou. Anjeneral, kreditè a gen egzijans ki trè espesifik sou fason ou pral kapab itilize lajan an.

Anpil pwogram lokal ede refijye ak imigran kòmanse pwòp biznis yo, ba yo konsèy sou biznis ak atelye finansye.

Jwenn èd

sit entènèt | Ofri |

|---|---|

Pwogram achte kay, prè pou pwopriyetè ti biznis yo, ak pwogram epay pou refijye yo | |

Kowoperativ yo tankou labank men yo se antite san pwofi epi se manm kowoperativ yo ki posede yo. Yo gen plis chans pou prete lajan oswa bay kat kredi a moun ki gen ti revni oswa moun ki pa gen okenn istorik kredi | |

Prè lajan pou ti biznis yo, nouvo biznis yo epi pou konstriksyon lojman ki abòdab. Yo pa vle fè pwofi nan sèvis yo ap ofri yo | |

Prè asistans pou imigrasyon pou ou ka peye dosye imigrasyon ou a | |

Prè biznis (soti nan $500 rive jous nan $250,000) pou pwopriyetè ti biznis nan Washington DC, Maryland, Virginia, ak Puerto Rico | |

Ede kominote yo gen plis aksè ak konpreyansyon konsènan kowoperativ kredi yo | |

Ede ou jwenn yon fason pou peye dèt kat kredi ou. Bay konsèy sou kredi ak pwogram jesyon dèt | |

Prè pou antreprenè ak enterè 0% pou ti biznis ameriken. Yon òganizasyon san pwofi k ap ede kominote ki pa resevwa ase sèvis yo | |

Prè pou ankouraje devlopman biznis ak kreyasyon travay pou imigran premye jenerasyon nan New Hampshire | |

Prè ak konsèy sou biznis pou imigran ak refijye ki gen yon istorik kredi limite oswa ki pa abitye ak enstitisyon finansye | |

Prè pou imigran, ak moun ki gen istorik kredi limite oswa ki pa gen okenn kredi ditou Ozetazini | |

Prè pou biznis ou Administrasyon an Ti Biznis la garanti w |

Kijan pou bati kredi w

Lè w ap resevwa yon kat kredi oswa yon prè, yo egzije pou ou gen yon istorik kredi. Istorik kredi se yon dosye sou fason ou itilize lajan ou. Li montre si ou te itilize yon kat kredi, si w te gen yon prè, epi si ou konn peye fakti ou a tan.

Kat kredi sekirize yo se yon bon fason pou w kòmanse bati kredi ou. Peye fakti ou yo alè, tankou fakti elektrisite ou ak fakti telefòn selilè ou ede w nan sa tou.

Enfòmasyon ki soti nan istorik kredi ou ale nan rapò kredi ou.

Yon rapò kredi gen ladan l enfòmasyon pèsonèl ak finansye. Konpayi yo sèvi ak rapò sa a pou konnen ou byen anvan yo prete ou lajan oswa apwouve ou pou yon kat kredi oswa yon ipotèk. Pafwa anplwayè yo mande rapò sa a pandan pwosesis aplikasyon w pou travay.

Selon istorik kredi ou, ou pral resevwa yon nòt kredi. Nimewo sa a montre si ou gen bon oswa move kredi. Yon nòt segondè se 700 ak pi wo, ak yon nòt ki ba se alantou 300. Èske w gen bon kredi ap ba ou plis chwa lè w ap mande pou yon prè oswa peye mwens enterè.

Aprann plis sou kijan pou bati istorik kredi ou.

Objektif nou se pou ofri enfòmasyon ki fasil pou konprann e ki ajou regilyèman. Enfòmasyon sa a se pa konsèy legal.