Jwenn. Aprann. Pwospere.

Enfòmasyon kominote imigran yo ka konte sou li

Pran yon klas gratis sou entènèt

Aprann nenpòt kote

Etidye sou telefòn ou oswa sou yon òdinatè. Aprann nenpòt lè, kèlkeswa kote ou ye.

Fasil pou itilize

Ale nan pwòp vitès ou. Li leson epi pran egzamen otan ou vle.

Fèt pou ou

Klas nou yo te fèt pou elèv k ap aprann lang anglè.

Klas GED®

Etidye pou diplòm GED® ou sou Entènèt. Avèk yon diplòm lekòl segondè, ou ka ale nan kolèj oswa jwenn yon pi bon travay.

Pran klas la

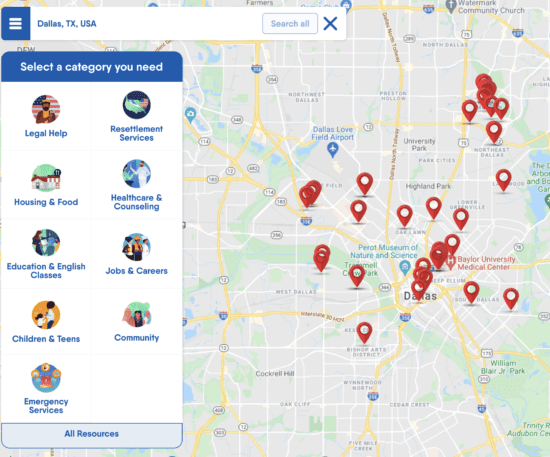

Jwenn èd toupre w

Jwenn èd legal, klas Anglè, klinik sante, sipò lojman, ak plis ankò. Chèche yon kat jeyografik lokal ak lis sèvis pou imigran nan Etazini a ak aplikasyon FindHello a.