Ki sa ki se yon bank oswa inyon kredi?

Nan Etazini, gen anpil kalite enstitisyon finansye. Gen bank, inyon kredi, ak asosyasyon prè. Chak ofri yon varyete sèvis epi yo gen règ ak pwoteksyon diferan.

Bank:

- se pou pwofi

- jeneralman gen plis kote ak ATM epi yo ka jwenn nan tout peyi a

- ka ofri plis opsyon bankè ki baze sou teknoloji tankou apps

- gen to enterè ki gen tandans pi wo

- yo pi popilè pase inyon kredi

Inyon kredi:

- yo pa gen pwofi

- anjeneral yo konekte ak yon kote espesifik

- gen abònman konsa ou ta ka oblije ranpli sèten kondisyon yo dwe yon manm

- gen tipikman mwens kondisyon ak frè

- yo konnen pou sèvis kliyan ak edikasyon finansye

Bank ak inyon kredi aksepte depo, bay prè, ak chèk pwosesis. Yo bay sèvis tankou bank an liy, transfè lajan, ak jesyon finans.

| Bank branch se yon tèm ki itilize pou yon bilding oswa yon kote ou ka fè bank an pèsòn. |

Poukisa mwen ta dwe louvri yon kont labank?

Kenbe gwo kantite lajan lakay ou oswa avèk ou ka gen gwo risk. Li ka vòlè, domaje, oswa pèdi. Li pi bon pou sere pi fò nan lajan w nan yon bank oswa yon inyon kredi. Dè milyon de moun nan Etazini itilize bank yo. Gen anpil avantaj pou ouvèti yon kont labank.

- Lajan ou an sekirite. Jiska $250,000 pwoteje pa FDIC ak bank yo ak NCUA ak kredi inyon yo.

- Ou jwenn pwoteksyon kont erè ak fwod. Si gen yon erè oswa yon tranzaksyon san otorizasyon, ou ka notifye bank la pou jwenn lajan ou tounen.

- Ou ka transfere lajan bay fanmi ak zanmi byen vit. Pifò bank ap ede w fè transfè epi voye lajan entènasyonalman.

- Li ede w gade finans ou ak anpil atansyon. Swiv deklarasyon labank ou chak mwa pou tcheke bidjè ou epi resevwa alèt lè lajan ou ba.

- Ou ka jwenn peye pi fasil ak pi vit ak depo dirèk nan men anplwayè w la.

- Ou ka peye bòdwo elektwonikman sa ki ka ede w pwograme yo alè epi ba w yon dosye sou peman.

- Ou ka fè acha sou entènèt ki pwoteje.

- Li bay prèv yon adrès lè l sèvi avèk deklarasyon labank ou yo.

- Li ka ede ak dosye imigrasyon . Li kapab montre yon dosye sou dat ou te Ozetazini ak kantite taks ou te peye.

Kouman pou mwen chwazi yon bank?

Anvan w chwazi yon bank, ou ta dwe mande zanmi ak fanmi rekòmandasyon. Chèche an liy epi li revize.

Tcheke kondisyon ak opsyon ki baze sou estati imigrasyon ou. Ou ka tcheke tou ki bank ki ofri karakteristik ak sipò nan yon lòt lang san konte Anglè.

Gade pou wè si yo gen yon kote ak ATM pa kote w ap viv oswa travay. Ou ka rele oswa ale nan yon bank pou poze kesyon sou kondisyon, frè espesyal, ak benefis yo.

Frè labank

Bank yo gen diferan frè ak depans ki asosye ak kont ou. Sa yo ka enkli:

- Frè ATM: sa yo kapab si ou itilize yon ATM nan yon lòt bank ki pa pwòp ou a

- Frè antretyen: depans chak mwa pou kenbe kont lan epi enkli balans minimòm ak limit maksimòm tranzaksyon yo

- Frè pou dekouvè: si ou te pran oswa depanse plis pase sa ou genyen nan kont ou.

- Frè oswa frè transfè: sa a kapab lè ou voye lajan entènasyonalman oswa nan kont labank lòt moun

Li enpòtan pou tcheke frè bank la anvan ou enskri. Ou ka mande si ou kalifye pou yon kont san frè.

| Gen kèk bank ki ofri bank espesyalman pou imigran yo, tankou Majority, Comun, ak Juntos Avanzamos Credit Unions pou kominote Panyòl la. |

Kouman pou mwen louvri yon kont labank?

Gen kèk kont labank ka louvri an liy epi san yo pa ale nan yon kote. Si w ap itilize yon ITIN pou ouvri yon kont labank, pwobableman w ap bezwen ale nan filyal labank la. Si w ap louvri yon kont konjwen oswa pataje, tou de moun bezwen prezan pou ouvri kont lan.

Asire ou ke ou pote nenpòt dokiman obligatwa epi gen yon lis nenpòt kesyon ou ta ka genyen.

Malgre ke yo ka diferan, kèk kondisyon pou louvri yon kont labank enkli:

- Fè omwen 18 an.

- Gen 2 fòm idantifikasyon foto gouvènman an bay tankou lisans chofè w oswa paspò w.

- Prèv adrès aktyèl la tankou yon bòdwo sèvis piblik sou non ou.

- Yon Nimewo Sekirite Sosyal (SSN) oswa Nimewo Idantifikasyon Endividyèl Taxpayer (ITIN).

- Nimewo telefòn ak adrès imel.

- Yon ti kantite lajan pou depoze, anjeneral ant $25 ak $100

Èske mwen ka louvri yon kont labank si mwen pa yon sitwayen ameriken oswa si mwen pa gen papye?

Wi. Ou ka toujou louvri yon kont labank nan Etazini menm si ou pa yon sitwayen ameriken oswa ou pa gen papye. W ap bezwen ranpli sèten kondisyon, tankou bay idantifikasyon ak prèv adrès.

Gen kèk bank ak inyon kredi ki pèmèt ou sèvi ak idantifikasyon etranje si ou pa gen yon ID US. Ou kapab tou itilize yon ITIN (Nimewo Idantifikasyon Endividyèl Taxpayer) olye de yon Nimewo Sekirite Sosyal (SSN) nan kèk bank.

Ou pa bezwen pwouve estati imigrasyon ou pou ouvri yon kont. Sepandan, estati imigrasyon ou ka afekte si yon bank apwouve ou pou kredi.

Ki kalite kont labank yo ye?

Kont kouran

Kont chèk pèmèt ou aksè rapid nan lajan ou. Ou ka ekri yon chèk, epi itilize yon kat debi nan yon Automatic Teller Machine (ATM). Ou kapab tou fè transfè an liy ak yon kont kouran.

Kont epay

Kont epay ede ou ekonomize lajan pou lavni. Ou ka touche enterè lè w mete lajan nan yon kont epay. Men, pifò kont epay sèlman pèmèt ou pran lajan kèk fwa pa mwa.

| Li ka pran tan pou louvri yon kont labank ak aplikasyon w lan. Prepare w pou w tann 7-10 jou ouvrab pou w jwenn enfòmasyon sou kont ou. |

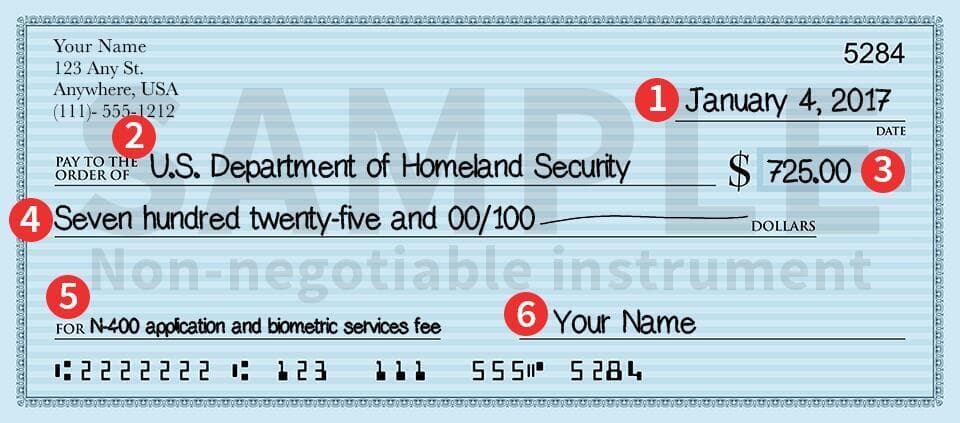

Kouman pou mwen ekri yon chèk?

Apre ou louvri kont epay ou oswa kont chèk ou, ou ka resevwa chèk. Chèk yo se yon moso papye ki konsidere kòm yon dokiman legal. Ou ranpli yon chèk pou peye pou bagay sa yo.

Moun k ap resevwa chèk ou a depoze l nan bank yo, epi bank ou a peye yo sou kont ou. Ou ka itilize chèk pou peye bòdwo, tankou lwaye w ak sèvis piblik yo. Gen kèk magazen ak biznis ki aksepte chèk tou.

Pou ekri yon chèk, w ap bezwen enkli:

- Dat. Ekri dat la sou bò dwat anlè chèk la. Nan Etazini, lòd dat la se mwa, jou, ak ane.

- Kiyès w ap peye. Ekri non yon moun oswa yon biznis akote "Peye nan lòd la".

- Kantite lajan lè l sèvi avèk chif. Ekri kantite lajan ou vle peye ak nimewo ki nan bwat ki gen yon siy dola.

- Kantite lè l sèvi avèk mo. Ekri kantite lajan ou vle peye lè l sèvi avèk mo sou liy vid la anba "Peye nan lòd la".

- Objektif chèk la. Akote mo Memo a, ou ka ekri kisa chèk la ye.

- Siyati. Ou dwe mete siyati ou. Sa vle di ou otorize chèk la.

Kouman pou mwen itilize yon kat debi?

Yon kat debi se yon kat plastik ou ka itilize pou jwenn lajan nan kont labank ou oswa pou fè acha menm jan ou fè ak yon kat kredi.

Ou ka retire lajan nan kont labank ou lè l sèvi avèk yon machin ATM. Yo anjeneral deyò bank ou. Ou ka jwenn tou ATM nan anpil magazen ak kote piblik. ATM ki pa fè pati bank ou a ka fè w peye yon frè siplemantè pou w ka jwenn lajan kach.

Ou ka sèvi ak kat debi ou tou pou peye bagay ki nan magazen, an liy ak nan telefòn. Li retire lajan an chak fwa nan kont labank ou. Asire w ou tcheke si gen frè pou itilize kat debi ou.

Ou bezwen yon PIN (nimewo idantifikasyon pèsonèl) pou itilize kat ou a. Ou antre PIN ou chak fwa ou pran lajan nan ATM oswa achte yon bagay. Si w pèdi kat la oswa yo vòlè w, pèsonn pa ka sèvi ak li sof si yo konnen PIN la.

Aprann plis sou kat debi, kredi, ak prè.

Kouman pou mwen jere kont labank mwen an?

Kantite lajan ou genyen nan kont labank ou se balans ou. Konsèy sa yo ka ede w jere kont ou epi evite erè ki koute chè:

- Konnen balans ou. Ou ka tcheke konbyen lajan ou genyen nan kont ou lè w mande nan bank la, tcheke nan yon ATM, oswa an liy.

- Sèvi ak sit entènèt ak aplikasyon bank ou a. Sèvi ak resous an liy yo pou jere peman, depo chèk, ak lòt tranzaksyon.

- Konprann frè bank ou a pou evite frè siplemantè ak frè dekouvè.

- Sèvi ak depo dirèk ak peman otomatik yo. Avèk depo dirèk, ou ka jwenn aksè nan chèk ou nan jou peman an. Epi, ak peman otomatik, ou elimine risk pou w manke yon peman.

- Depoze yon plent. Si w gen nenpòt pwoblèm ak bank ou a, ou ka pote yon plent ak gouvènman ameriken an.

Aprann plis sou fè yon bidjè pou ekonomize lajan.

Konnen ki jan yo pwoteje tèt ou kont move ak fo sit entènèt. Aprann sa pou w fè si w te viktim fwod.

Objektif nou se pou ofri enfòmasyon ki fasil pou konprann e ki ajou regilyèman. Enfòmasyon sa a se pa konsèy legal.