Thẻ tín dụng

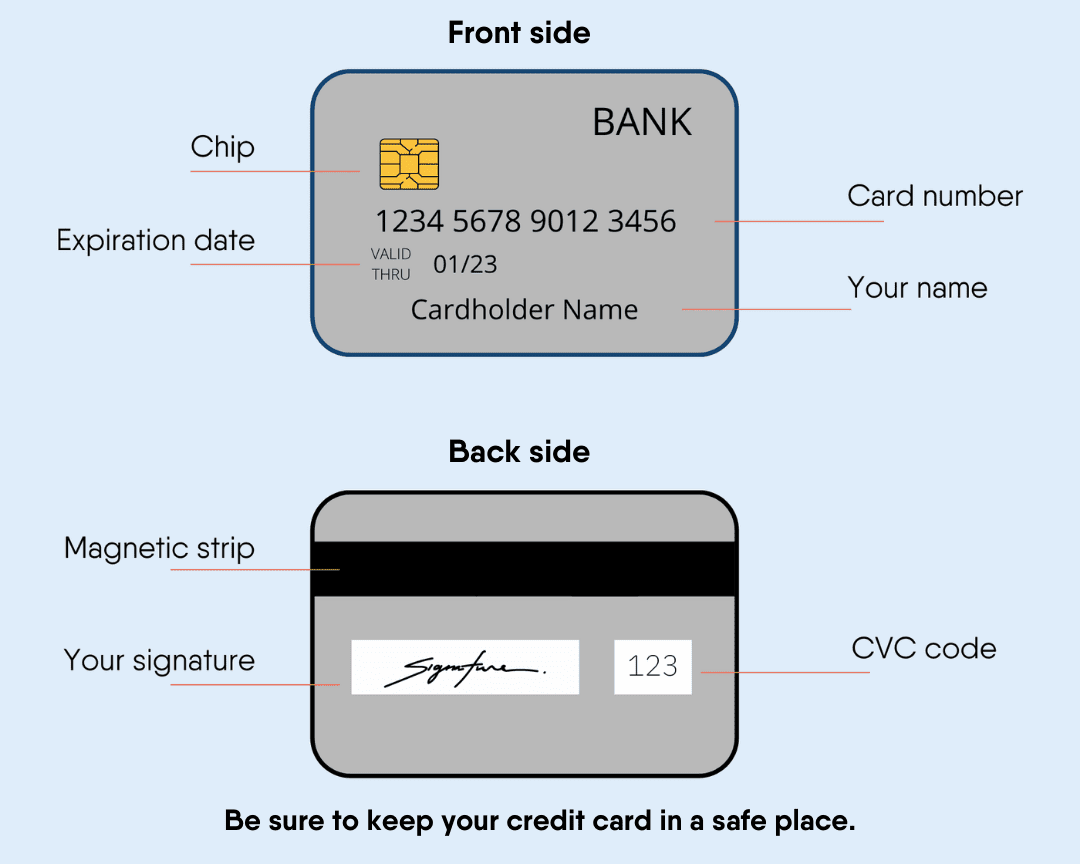

Hàng triệu người có thẻ tín dụng ở Hoa Kỳ. Mọi người sử dụng thẻ tín dụng khi mua sắm trực tuyến, thanh toán cho những thứ đắt tiền hoặc không muốn dùng tiền mặt.

Thẻ tín dụng dễ sử dụng và an toàn. Họ thường giới hạn số tiền bạn có thể chi tiêu và yêu cầu thanh toán tối thiểu cho công ty thẻ tín dụng hàng tháng. Điều quan trọng là luôn phải thanh toán số tiền tối thiểu theo yêu cầu, nếu không bạn sẽ phải trả phí trả chậm.

Nếu bạn không thanh toán cho công ty thẻ tín dụng toàn bộ số tiền mua hàng, bạn sẽ có số dư. Số dư trên thẻ tín dụng của bạn thường sẽ tăng do lãi suất. Lãi suất là khoản phí bổ sung mà công ty thẻ tín dụng tính khi cho bạn vay tiền. Số dư được coi là một khoản nợ.

Nhiều người có số dư trên thẻ tín dụng. Nợ nần có thể gây căng thẳng. Điều quan trọng là phải mua hàng bằng thẻ tín dụng mà bạn biết mình có thể thanh toán trong khoảng thời gian hợp lý.

Tìm loại thẻ tín dụng phù hợp nhất với bạn.

Các loại thẻ khác

Có nhiều loại thẻ khác mà bạn có thể sử dụng thay cho thẻ tín dụng tiêu chuẩn.

Để mở thẻ tín dụng được bảo đảm, bạn sẽ cần phải gửi tiền. Khoản tiền gửi tối thiểu thường là hơn 40 đô la và trong một số trường hợp, bạn có thể nhận được khoản tín dụng lên tới 200 đô la. Tổ chức phát hành thẻ tín dụng sẽ giữ số tiền này trong khi tài khoản vẫn mở. Nếu bạn thanh toán đúng hạn, bạn có thể lấy lại tiền đặt cọc và nâng cấp lên thẻ tín dụng thông thường.

Loại thẻ này sẽ giúp bạn xây dựng lịch sử tín dụng của mình.

Thẻ trả trước là một lựa chọn khác nếu bạn không có thẻ tín dụng.

Mỗi loại thẻ có giới hạn số tiền nạp vào và một số loại còn có tùy chọn nạp thêm tiền. Bất cứ ai cũng có thể mua những tấm thẻ này. Bạn có thể tìm thấy những loại thẻ này ở các siêu thị, cửa hàng và trạm xăng.

Bạn có thể mua hàng bằng thẻ trả trước giống như cách bạn mua hàng bằng thẻ tín dụng thông thường. Chúng có thể hữu ích cho việc thanh toán USCIS và các khoản thanh toán trực tuyến khác.

Việc sở hữu thẻ trả trước sẽ không giúp bạn xây dựng lịch sử tín dụng.

Hãy xem video này để biết điều gì sẽ xảy ra khi bạn không kiểm tra phí của thẻ trả trước.

Nguồn video: Ủy ban Thương mại Liên bang

Thẻ ghi nợ có thể được sử dụng như thẻ tín dụng. Bạn có thể nhận được thẻ ghi nợ sau khi mở tài khoản ngân hàng hoặc tài khoản tín dụng. Nó không cho phép bạn vay tiền. Nó chỉ có thể sử dụng số tiền trong tài khoản của bạn. Đôi khi có phí.

Thẻ ghi nợ không giúp bạn xây dựng tín dụng. Tìm hiểu thêm.

Nếu bạn không có số an sinh xã hội để đăng ký thẻ tín dụng, một số công ty có thể chấp nhận Mã số nhận dạng người nộp thuế cá nhân (ITIN) của bạn.

Một lựa chọn khác cho những người không có số an sinh xã hội là sử dụng thẻ tín dụng an toàn.

Cho vay

Khoản vay là số tiền bạn vay và phải trả lại cùng với lãi suất. Có nhiều loại hình cho vay khác nhau: cá nhân, trả lương, kinh doanh và các loại khác.

Khoản vay thường đến từ ngân hàng hoặc tổ chức tài chính. Họ sẽ kiểm tra xem bạn kiếm được bao nhiêu tiền từ công việc và liệu bạn có sở hữu những đồ vật có giá trị hay không. Điều này giúp họ quyết định xem họ có thể tin tưởng bạn sẽ trả được khoản vay hay không.

Thanh toán đúng hạn sẽ giúp bạn tránh khỏi nợ nần và xây dựng được lịch sử tín dụng.

Khoản vay trả lương dành cho những người cần tiền mặt nhanh chóng. Mọi người vay tiền từ người cho vay để trả nợ vào ngày họ nhận được lương.

Những khoản vay này còn được gọi là khoản vay trả trước bằng tiền mặt và thường có lãi suất cao.

Một số công ty cho vay trả lương sử dụng các biện pháp bất hợp pháp như tính lãi suất quá cao và các điều kiện không công bằng. Vui lòng đảm bảo bạn biết đầy đủ thông tin chi tiết về khoản vay trước khi ký.

Các hợp tác xã tín dụng cung cấp khoản vay thay thế trả lương (PAL). PAL là khoản vay ngắn hạn, do đó bạn không cần phải vay tiền trả lương.

Bạn có thể vay tới 1.000 đô la và họ sẽ không tính quá nhiều lãi suất. Bạn phải là thành viên của một tổ chức tín dụng trong một tháng trước khi có thể mở PAL.

Thế chấp là khoản vay mà mọi người nhận được để mua nhà. Bên cho vay sẽ kiểm tra lịch sử công việc, điểm tín dụng, thu nhập và các yếu tố khác của bạn để xem bạn có thể vay thế chấp hay không. Mỗi bên cho vay có lãi suất và lựa chọn khác nhau.

Việc thế chấp có thể phức tạp. Bạn nên hỏi chuyên gia bất động sản hoặc bạn bè để được gợi ý về nơi nên vay thế chấp. Bạn sẽ cần nhiều giấy tờ như biểu mẫu thuế liên bang, phiếu lương, sao kê ngân hàng, v.v.

Cơ quan Quản lý Nhà ở Liên bang (FHA) có nguồn thông tin về thế chấp và cách mua nhà.

Thường trú nhân (Người sở hữu Thẻ xanh) có thể vay thế chấp. Bạn sẽ cần các giấy tờ chứng minh rằng bạn đang cư trú hợp pháp tại Hoa Kỳ để nộp đơn. Và bạn sẽ cần phải tuân thủ các yêu cầu của ngân hàng hoặc bên cho vay. Một số giấy tờ cần thiết là:

- Thẻ xanh

- Hộ chiếu

- Số an sinh xã hội

- Phiếu lương gần đây

- Biểu mẫu W-2

- Khai thuế

- Sao kê ngân hàng

- Điểm tín dụng

Thường trú nhân cũng có thể đủ điều kiện vay vốn FHA. Các yêu cầu và điều kiện giống như đối với công dân Hoa Kỳ.

Những người không phải thường trú nhân cũng có thể nộp đơn xin thế chấp. Quy trình này phức tạp hơn. Người nộp đơn cần chứng minh rằng họ đang cư trú hợp pháp tại Hoa Kỳ. Trong hầu hết các trường hợp, thường trú nhân không thường trú sẽ phải chứng minh thu nhập từ nước ngoài.

Khoản vay dành cho sinh viên dành cho những người cần hỗ trợ để chi trả học phí. Sau này bạn sẽ phải trả lại, kèm theo lãi suất. Các khoản vay đến từ ngân hàng, tổ chức tài chính hoặc chính phủ. Đọc thêm về các khoản vay dành cho sinh viên và tìm các lựa chọn.

Có học bổng dành cho người nhập cư và người tị nạn để giúp bạn trang trải chi phí học tập.

Đây là những khoản vay để cải thiện hoặc khởi nghiệp kinh doanh của riêng bạn. Thông thường, bên cho vay sẽ có những cách rất cụ thể để bạn có thể sử dụng số tiền.

Nhiều chương trình địa phương giúp người tị nạn và người nhập cư khởi nghiệp kinh doanh bằng cách cung cấp lời khuyên kinh doanh và hội thảo về tiền bạc.

Tìm trợ giúp

Trang web | Ưu đãi |

|---|---|

Các chương trình mua nhà, cho vay cho chủ doanh nghiệp nhỏ và các chương trình tiết kiệm cho người tị nạn | |

Hợp tác tín dụng giống như ngân hàng nhưng là tổ chức phi lợi nhuận do các thành viên sở hữu. Họ có nhiều khả năng cho vay tiền hoặc cấp thẻ tín dụng cho những người có thu nhập thấp hoặc không có lịch sử tín dụng | |

Cho vay tiền cho các doanh nghiệp nhỏ, doanh nghiệp mới và xây dựng nhà ở giá rẻ. Họ không muốn kiếm lợi nhuận từ các dịch vụ của họ | |

Các khoản vay hỗ trợ nhập cư để bạn có thể chi trả chi phí cho trường hợp nhập cư của mình | |

Các khoản vay kinh doanh (từ 500 đô la đến 250.000 đô la) cho các chủ doanh nghiệp nhỏ ở Washington DC, Maryland, Virginia và Puerto Rico | |

Giúp cộng đồng cải thiện khả năng tiếp cận và hiểu biết của họ về các hợp tác tín dụng | |

Giúp bạn tìm cách thanh toán nợ thẻ tín dụng. Cung cấp các chương trình tư vấn tín dụng và quản lý nợ | |

Cho vay với lãi suất 0% dành cho các doanh nghiệp nhỏ tại Hoa Kỳ cho doanh nhân. Một tổ chức phi lợi nhuận giúp đỡ các cộng đồng khó khăn | |

Các khoản vay khuyến khích phát triển doanh nghiệp và tạo việc làm cho những người nhập cư thế hệ đầu tiên ở New Hampshire | |

Cho vay và tư vấn kinh doanh cho người nhập cư và người tị nạn có lịch sử tín dụng hạn chế hoặc không quen thuộc với các tổ chức tài chính | |

Các khoản vay dành cho người nhập cư và những người có lịch sử tín dụng hạn chế hoặc bằng không tại USA | |

Các khoản vay cho doanh nghiệp của bạn được bảo lãnh bởi Cục Quản lý Doanh nghiệp Nhỏ |

Làm thế nào để xây dựng tín dụng

Để có được thẻ tín dụng hoặc khoản vay, bạn cần phải có lịch sử tín dụng. Lịch sử tín dụng là hồ sơ ghi lại cách bạn sử dụng tiền của mình. Nó cho biết bạn có sử dụng thẻ tín dụng, có khoản vay và thanh toán hóa đơn đúng hạn hay không.

Thẻ tín dụng được bảo đảm là một cách tốt để bắt đầu xây dựng tín dụng của bạn. Thanh toán các hóa đơn đúng hạn, chẳng hạn như hóa đơn tiền điện và điện thoại di động, cũng có ích.

Thông tin từ lịch sử tín dụng của bạn sẽ được chuyển vào báo cáo tín dụng.

Báo cáo tín dụng bao gồm thông tin cá nhân và tài chính. Các công ty sử dụng báo cáo này để tìm hiểu về bạn trước khi cho bạn vay tiền hoặc chấp thuận cấp thẻ tín dụng hoặc thế chấp cho bạn. Đôi khi, nhà tuyển dụng yêu cầu báo cáo này trong quy trình ứng tuyển việc làm.

Dựa trên lịch sử tín dụng của bạn, bạn sẽ nhận được số điểm tín dụng. Con số này cho biết bạn có tín dụng tốt hay xấu. Điểm cao là 700 trở lên và điểm thấp là khoảng 300. Có tín dụng tốt sẽ giúp bạn có nhiều lựa chọn hơn khi vay vốn hoặc trả ít lãi suất hơn.

Tìm hiểu thêm về việc xây dựng lịch sử tín dụng của bạn.

Chúng tôi mong muốn cung cấp thông tin dễ hiểu được cập nhật thường xuyên. Thông tin này không phải là lời khuyên pháp lý.