What is a bank or credit union?

In the United States, there are many types of financial institutions. There are banks, credit unions, and loan associations. Each offers a variety of services and has different rules and protections.

Banks:

- are for-profit

- generally have more locations and ATMs and can be found nationwide

- can offer more tech-based banking options like apps

- have interest rates that tend to be higher

- are more popular than credit unions

Credit Union:

- are non-profit

- usually are connected with a specific location

- have memberships so you might have to meet certain requirements to be a member

- have typically less requirements and fees

- are known for customer service and financial education

Banks and credit unions accept deposits, issue loans, and process checks. They provide services such as online banking, money transfers, and finance management.

| Bank branch is a term used for a building or location where you can do banking in person. |

Why should I open a bank account?

Keeping large amounts of money in your home or with you can have big risks. It can get stolen, damaged, or lost. It is better to store most of your money with a bank or credit union. Millions of people in the United States use banks. There are many benefits to opening a bank account.

- Your money is safe. Up to $250,000 is protected by the FDIC with banks and the NCUA with credit unions.

- You get protection against error and fraud. If there is a mistake or an unauthorized transaction, you can notify the bank to get your money back.

- You can transfer money to family and friends quickly. Most banks will help you make transfers and send money internationally.

- It helps you watch your finances closely. Follow your monthly bank statements to check your budget and get alerts when your money is low.

- You can get paid easier and quicker with direct deposits from your employer.

- You can pay bills electronically which can help you schedule them on time and gives you a record of payment.

- You can make online purchases that are protected.

- It gives proof of an address by using your bank statements.

- It can help with immigration records. It could show a record of dates that you have been in the U.S. and the amount of taxes you have paid.

How do I choose a bank?

Before choosing a bank, you should ask friends and family for recommendations. Search online and read reviews.

Check for requirements and options based on your immigration status. You can also check which banks offer features and support in another language besides English.

Look to see if they have a location and ATMs by where you live or work. You can call or go to a bank to ask questions about conditions, special fees, and benefits.

Bank fees

Banks have different fees and costs associated with your account. These can include:

- ATM fees: these can be if you use an ATM from another bank that is not your own

- Maintenance fees: monthly costs to keep the account and include minimum balances and maximum transaction limits

- Overdraft fees: if you mistakenly take out or spend more than you have in your account.

- Wire or transfer fees: this can be when you send money internationally or to other people’s bank accounts

It is important to check the bank’s fees before you sign up. You can ask if you qualify for a no-fee account.

| Some banks offer banking specifically for immigrants, such as Majority, Comun, and Juntos Avanzamos Credit Unions for the Hispanic community. |

How do I open a bank account?

Some bank accounts can be opened online and without going to a location. If you are using an ITIN to open a bank account, you will probably need to go to the bank branch. If you are opening a joint or shared account, both people need to be present to open the account.

Be sure to bring any required documents and have a list of any questions you might have.

Although they could differ, some requirements to open a bank account include:

- Be at least 18 years old.

- Have 2 forms of government-issued photo identification such as your driver’s license or your passport.

- Proof of current address such as a utility bill in your name.

- A Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Phone number and email address.

- A small amount of money to deposit, usually between $25 and $100

Can I open a bank account if I am not a U.S. citizen or if I am undocumented?

Yes. You can still open a bank account in the USA even if you are not a U.S. citizen or are undocumented. You will need to meet certain requirements, such as providing identification and proof of address.

Some banks and credit unions allow you to use foreign identification if you do not have a U.S. ID. You can also use an ITIN (Individual Taxpayer Identification Number) instead of a Social Security Number (SSN) at some banks.

You do not need to prove your immigration status to open an account. However, your immigration status might affect whether a bank approves you for credit.

What are the types of bank accounts?

Checking account

Checking accounts allow you fast access to your money. You can write a check, and use a debit card at an Automatic Teller Machine (ATM). You can also make online transfers with a checking account.

Savings account

Savings accounts help you save money for the future. You can earn interest by putting money in a savings account. But, most savings accounts only allow you to take money out a few times per month.

| It can take time to open a bank account and process your application. Be prepared to wait 7-10 business days to get your account information. |

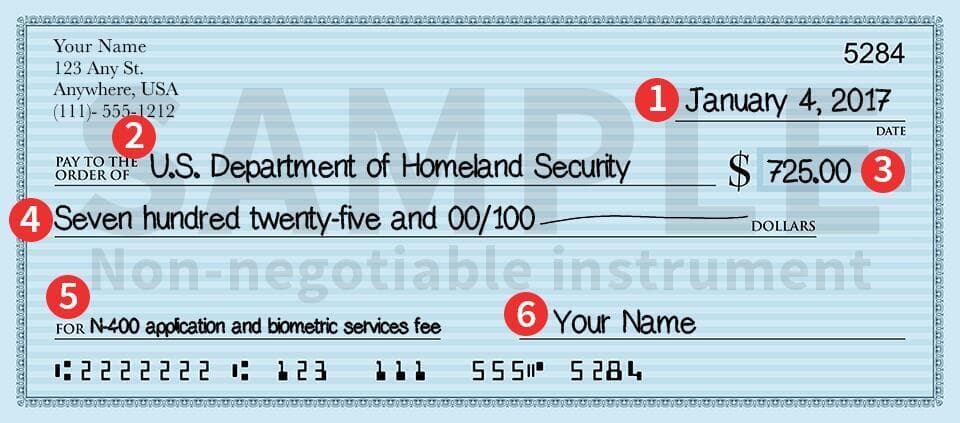

How do I write a check?

After you open your savings or checking account, you may receive checks. Checks are a piece of paper that is considered a legal document. You fill out a check to pay for things.

The person receiving your check deposits it in their bank, and your bank pays them out of your account. You can use checks to pay bills, such as your rent and utilities. Some stores and businesses accept checks too.

To write a check, you will need to include:

- Date. Write the date on the top right side of the check. In the USA, the date order is month, day, then year.

- Who you are paying. Write a person or business name next to “Pay to the order of”.

- Amount using digits. Write the amount you want to pay using numbers in the box with a dollar sign.

- Amount using words. Write the amount you want to pay using words on the empty line under “Pay to the order of”.

- Purpose of the check. Next to the word Memo, you can write what the check is for.

- Signature. You must include your signature. This means you are authorizing the check.

How do I use a debit card?

A debit card is a plastic card you can use to get money out of your bank account or to make purchases as you do with a credit card.

You can withdraw money from your bank account using an ATM machine. They are usually outside your bank. You can also find ATMs in many stores and public places. ATMs that do not belong to your bank may charge you an extra fee to get cash.

You can also use your debit card to pay for things in stores, online, and over the phone. It deducts the money each time from your bank account. Be sure to check if there are fees for using your debit card.

You need a PIN (personal identification number) to use your card. You enter your PIN every time you take money out of the ATM or buy something. If you lose the card or get stolen, nobody can use it unless they know the PIN.

Learn more about debit cards, credit, and loans.

How do I manage my bank account?

The amount you have in your bank account is your balance. The following tips could help you manage your account and avoid costly mistakes:

- Know your balance. You can check how much money you have in your account by asking at the bank, checking at an ATM, or online.

- Use your bank’s website and app. Use the online resources to manage payments, check deposits, and other transactions.

- Understand your bank’s fees to avoid extra charges and overdraft fees.

- Use direct deposit and automatic payments. With direct deposit, you can access your paycheck on payday. And, with automated payments, you eliminate the risk of missing a payment.

- File a complaint. If you have any issues with your bank, you can file a complaint with the U.S. government.

Learn more about making a budget to save money.

Know how to protect yourself from notarios and fake websites. Learn what to do if you have been a victim of fraud.

We aim to offer easy to understand information that is updated regularly. This information is not legal advice.